LPL Retirement Advisors Lead The Way

By working with an LPL advisor, you can help put your employees on the path toward achieving a secure retirement. Advisors who work with LPL are leading the way to retirement readiness for a generation of employees. Their success comes from your plan’s success. With dedication, cutting edge tools and high-impact education, combined with a commitment to impeccable service, LPL retirement advisors will help you set a clear direction toward retirement readiness.1

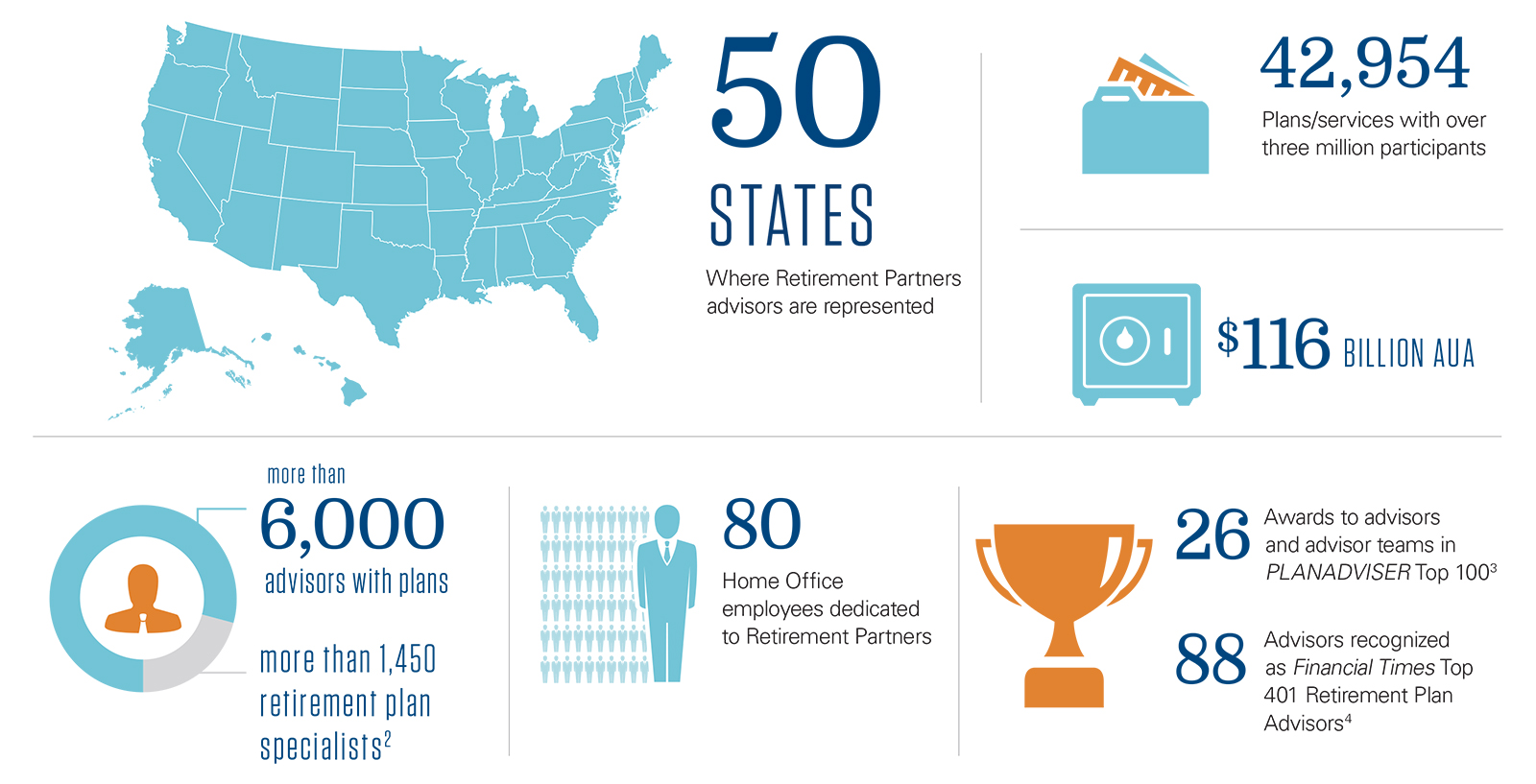

About LPL Retirement Partners

LPL Retirement Partners is the retirement plan-focused division of LPL Financial LLC (“LPL Financial”), the nation’s largest independent broker/dealer(based on total revenues, Financial Planning magazine, June 1996–2016). Through its integrated business platform and team of retirement industry experts, LPL Retirement Partners supports the operational and practice management needs of retirement plan advisors who offer retirement plan services to plan sponsors and their employees.

About LPL Financial

LPL Financial, a wholly owned subsidiary of LPL Financial Holdings Inc. (NASDAQ: LPLA), is the nation’s largest independent broker/dealer (based on total revenues, Financial Planning magazine, June 1996–2016), an RIA custodian, and an independent consultant to retirement plans. LPL offers proprietary technology, comprehensive clearing and compliance services, practice management programs and training, and independent research to more than 14,000 financial advisors and approximately 700 financial institutions. In addition, LPL supports approximately 4,500 financial advisors licensed with insurance companies by providing customized clearing, advisory platforms, and technology solutions. LPL and its affiliates have more than 3,300 employees—with primary offices in Boston, Charlotte, and San Diego.

For more information, please visit www.lpl.com.

1. All data as of 10/2015.? 2. Must work with at least 5 qualified retirement plans and have at least $5 million in plan assets. 3. PLANADVISER 2015 Top 100 Retirement Plan Advisers list. Advisors selected solely on quantitative factors, including plan assets and number of plans, as reported directly by nominees. 4. 2015 Financial Times Top 401 Retirement Plan Advisors: financial advisors managing at least $25 million in defined contribution (DC) plan assets and for whom DC plans represent at least 20% of total AUM. Selected based on eight broad factors, including DC plan AUM, DC specialization, growth in DC plan assets and number of plans, average participation rate in advised plans, years of experience, industry certifications and compliance record.